Silber: In the shade of gold...

Purpose

The precious metal silver is an underestimated metal that is used in many applications. Silver has greater color brightness, polishability and reflectivity than other precious metals and also outperforms them in terms of electrical conductivity and thermal conductivity. Silver is easy to process and only reacts chemically with a few substances such as sulphur and sulphur derivatives. Silver is almost exclusively used as an alloy with copper, as silver is too soft in its pure form. Looking at the high demand for silver in industry, it quickly becomes clear that the ...

The precious metal silver is an underestimated metal that is used in many applications. Silver has greater color brightness, polishability and reflectivity than other precious metals and also outperforms them in terms of electrical conductivity and thermal conductivity. Silver is easy to process and only reacts chemically with a few substances such as sulphur and sulphur derivatives. Silver is almost exclusively used as an alloy with copper, as silver is too soft in its pure form. Looking at the high demand for silver in industry, it quickly becomes clear that the silver price trend is very strongly linked to industrial demand. In such a case, the current silver price can also move accordingly. Silver is often produced during the extraction of base metals; in its pure form, the white precious metal is even rarer than gold. Instead, around 70 percent of silver production comes from copper, lead and zinc mining. In nature, silver ores are often interspersed with lead ores, meaning that only around 20,000 tons of silver are extracted worldwide each year.

Some areas of application for silver: batteries, solar panels, media storage, cosmetics, antibacterial products (e.g. medical gowns), stained glass, 3D printing, water purification, detergents, plastics, automotive industry, RFID chips, photography, food industry.

The price of silver has been rising steadily for several years, as the supply of silver cannot meet the high and rising demand. Mexico, Peru and Australia are considered the most important producers of silver. However, silver is also produced in China, Poland, Russia, Canada and the USA. The most important trading venues for silver are the New York Mercantile Exchange (COMEX division), the Tokyo Commodity Exchange, the Chicago Board of Trade and the London Bullion Market. The total value of silver traded on the exchange is estimated at around USD 17 billion.

Analysis

At Financial Dynamics, we have been bullish on this precious metal since the beginning of 2020 and at a price well below USD 20. There are many reasons for this. Not only are the industrial applications steadily increasing. As the most conductive metal, it is increasingly in demand for applications in the clean energy sector and especially for solar panels. However, it is not only the most conductive metal - even more conductive than copper - it is also antibacterial and therefore in great demand in the medical technology sector.

But in times of record global debt and ...

At Financial Dynamics, we have been bullish on this precious metal since the beginning of 2020 and at a price well below USD 20. There are many reasons for this. Not only are the industrial applications steadily increasing. As the most conductive metal, it is increasingly in demand for applications in the clean energy sector and especially for solar panels. However, it is not only the most conductive metal - even more conductive than copper - it is also antibacterial and therefore in great demand in the medical technology sector.

But in times of record global debt and practically exponentially increasing interest costs (see USA), the above factors are not even the most important. Silver has no “counterparty risk” and has historically been used as “money” more often than gold. It is not for nothing that silver means “money” in countless languages. We therefore assume that investors are increasingly recognizing precisely these properties, which is why investment demand could rise sharply. If the stock markets are already expensively valued in many places, bonds no longer offer any real security and other investment prices such as real estate prices are also extremely high, we assume that many investors will look for something in the future that is massively undervalued compared to other investments from a historical perspective and that cannot fall to “zero” with 100% certainty. Added to this are the factors of anonymity and independence from electricity/Internet when making physical purchases.

We now read articles almost every week about how silver is now being used in technological products. Just recently, for example, Samsung announced that it had achieved a breakthrough with the “solid state battery”. Silver is of crucial importance for their realization. Around 1 kg of silver would be needed per electric car. It needs no further explanation that this would lead to a sharp increase in demand if this technology were to become established. The “solid state battery” has the advantage that a range of 600 km can be charged in just 9 minutes.

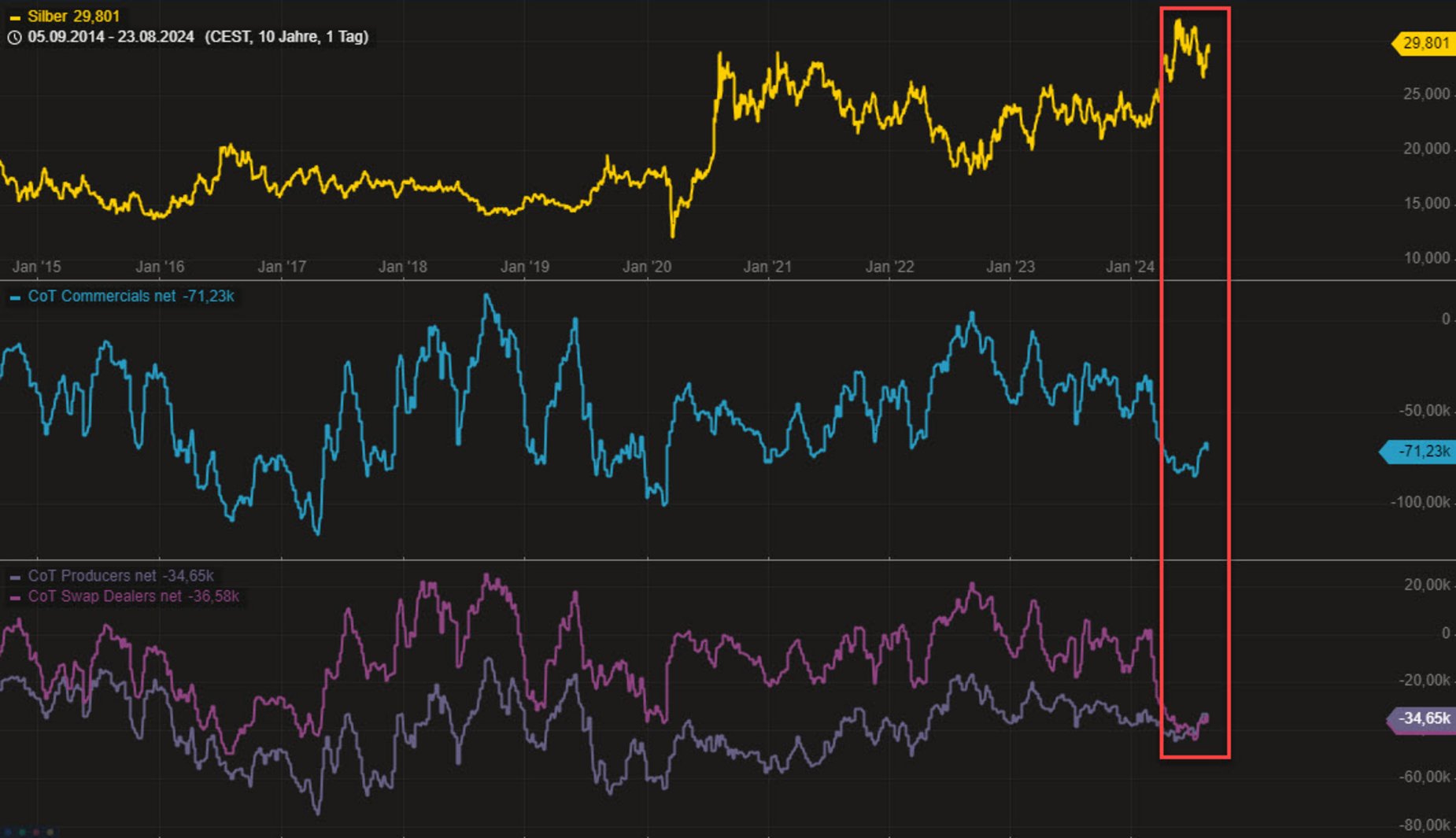

But since we at Financial Dynamics know that “opinions” and “fundamental analysis” of an asset can never be enough to complete a solid, well-founded analysis, we will now turn to the technical side:

In terms of sentiment, it is clear that we are miles away from any form of euphoria that would be typical of a final top. In the case of precious metals, it is more of a panic due to monetary uncertainties, war, etc. Seasonally, a positive phase is imminent until around the end of September. According to the Elliott wave theory, major upward movements should still be imminent. The upward movement from the beginning to around mid-2020 was a wave “i”, which was interrupted by a very long, arduous, dubious wave “ii”. In our view, we have been in the early stages of wave “iii” since the end of 2022. In concrete terms, this means that the silver price should have the biggest upward leg ahead of it in terms of time and price.

Conclusion

- For silver, everything is intact on the upside. Only prices below USD 26 could give rise to slight concerns.

- However, we assume that silver will rise to USD 35, USD 37, later to USD 44 and even later to over USD 50 in the coming months.

- Please always bear in mind that this is not a “get-rich-quick-bet”, but an investment with a longer time horizon. Precious metals do not move by double-digit percentages overnight.

Silber

- VALOR 11948866

- ISIN US46428Q1094

- Author Oliver Dolezel

- Date 27.08.24

Analysis Performance

Performance since initial analysis

29.05.20

No rating available yet.

Comments

No comments yet.